China’s EV industry keeps expanding at high speed, and new sales data confirms a major shift in strength. BYD drives November results as local brands widen their lead while global players lose ground. CPCA figures highlight strong momentum for some companies and a difficult close to the year for others.

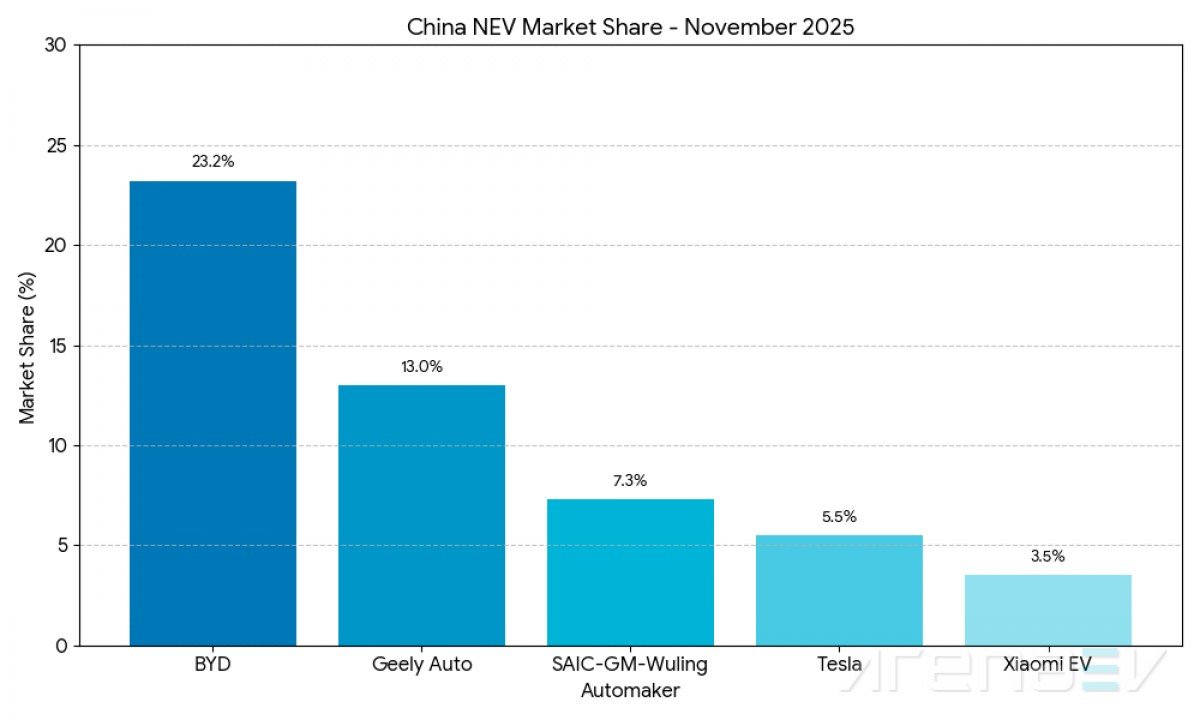

BYD, which offers pure electric and plug-in hybrid vehicles, reached 306,561 retail NEV sales in November. This result secured a 23.2 percent share. The gain over October’s 23.1 percent shows solid control at the top of the market.

Strong November Results with BYD Leading

Geely Auto finished second with 172,169 NEV sales. The company posted a 4.8 percent increase over October and a 42.4 percent rise over November last year.

Tesla returned to the top 10 after weak performance in October. The company delivered 73,145 vehicles in November. This jump from 26,006 units in the previous month reflects a 181.3 percent surge. Tesla placed fifth with a 5.5 percent share, though the total still dropped 5 percent compared to last year. BYD continues to benefit from this shift in demand.

Competition across China stays intense. SAIC-GM-Wuling recorded 96,194 NEV sales for third place and a 7.3 percent share. Xiaomi EV reached tenth place with 46,249 sales and a 3.5 percent share, supported by strong demand for the SU7 and YU7. The market pressure affects every brand, including BYD as it manages record output.

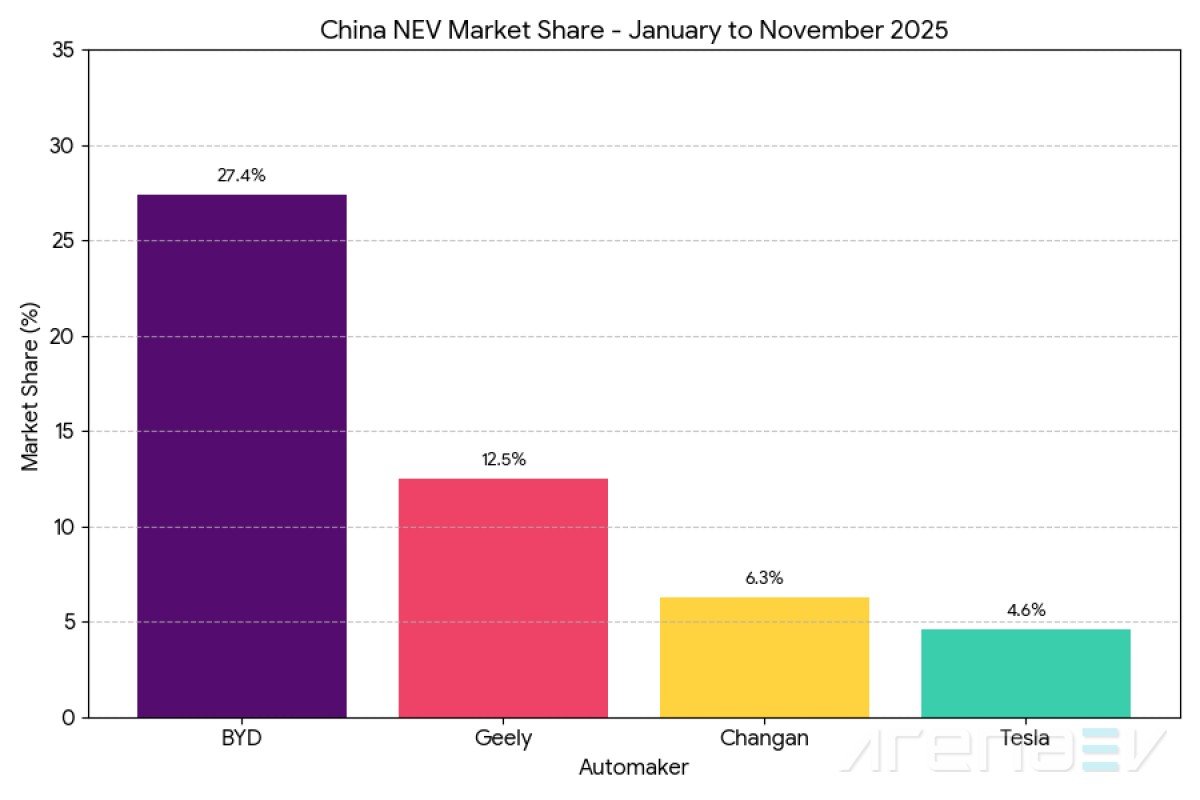

Year-to-date numbers show an even clearer picture. From January to November, BYD reached 3,144,671 NEV sales, holding a 27.4 percent share. Geely followed with 1,428,573 sales and a 12.5 percent share. Changan ranked third with 727,511 sales and a 6.3 percent share. Tesla placed fifth with 531,855 sales and a 4.6 percent share.

Tesla now faces a major yearly gap. The company ended 2024 with 657,105 sales. Matching that figure requires 125,250 deliveries in December. Tesla’s record retail month in China was December 2024 with 82,927 units, so reaching 125,250 is out of reach.

Even if Tesla reaches 85,000 deliveries in December, its annual total in China will still fall about 6 percent. Demand for the Model 3 and Model Y shows signs of slowing while Xiaomi and XPeng report triple-digit growth. The shift signals growing pressure on Tesla as buyers move to fresh options. BYD strengthens its lead while rivals try to close the gap.